Plend Financial Inclusion Report highlights the UK’s financial exclusion crisis with 1 in 5 Brits feeling locked out of the system

Click here to download the full report.

Today, we released our first Financial Inclusion Report, created in collaboration with Nationwide Building Society, Stepchange, Responsible Finance, Fair4all Finance, Fair By Design and Smart Data Foundry, to highlight the UK’s financial exclusion crisis and those most at risk in society.

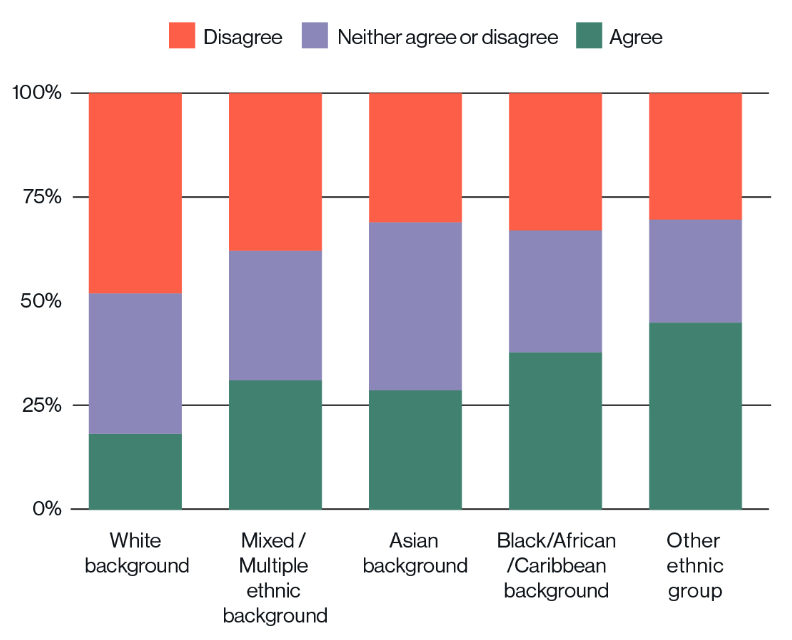

Research, conducted by Opinium from over 4,500 respondents shows that 1 in 5 Brits say they feel locked out of the financial system, nearly 11 million people. Access to affordable credit is vital for an individual’s financial stability and resilience but the report findings exposes that some sections of the UK population are repeatedly being badly let down by the financial services industry; 38% of people from a black ethnic group and 32% from all ethnic groups combined feel that they can’t access financial services.

Percentage of people who agree or disagree that they feel locked out of the financial system:

Without fair financial products available to those in vulnerable positions it means that those who need support the most, especially during the current cost of living crisis, are faced with paying significantly more for financial services and are ultimately excluded from affordable options. This creates a poverty premium meaning that things become more expensive for people who need help the most and they can become dependent on unreliable financial support.

Our research also revealed that Covid has exacerbated the problem of financial exclusion; more than a quarter (28%) of all Brits say they are now in a worse financial position as a result of the pandemic.

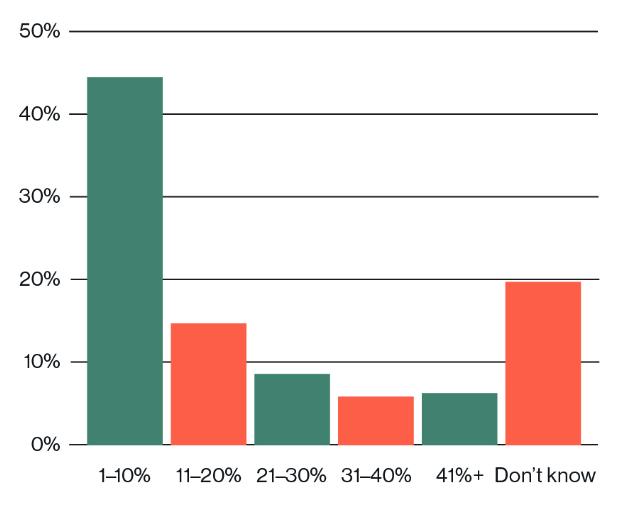

Percentage of people and the interest rate they pay on their loan:

Interest rates for loans were on average 16.3% according to the respondents, this rose to 21.6% for the under 34s, but shockingly nearly 20% don’t know the interest rate they are currently paying on their loans.

The report data also found that nearly half (47%) of those with a high cost loan simply pay back the minimum payments each month with 10% unable to manage even the minimum payments.

The flaws in the UK credit referencing system have long been recognised and traditional credit scoring methods often give an incomplete and outdated picture of an individual’s financial life, holding back over 20.3 million people in the UK from affordable financial services.

There is a huge amount of evidence that Open Banking technology, like what Plend uses to assess affordability, offers a more accurate picture of an individual’s financial position and thus is an important tool in efforts towards a more financially inclusive society.

Click here to read the full report